Wealth Screening for Nonprofits 101: A Look Beyond Net Worth

By Sarah Landman, Executive Vice President, Insightful

Imagine your nonprofit launches a campaign asking for major donations to fund a big project, like a new building. Who do you envision on the other end of those fundraising requests?

You’re likely not targeting those without the resources to support this initiative—like high schoolers without jobs—or those who show little interest in your work. After all, reaching out to those individuals would be a waste of your nonprofit’s resources.

Fundraising success hinges on targeting the right donors: those with both the capacity and willingness to give. That’s where wealth screening for nonprofits comes in: It’s the step in the prospect research process that helps your nonprofit find potential donors who can meet your fundraising needs.

In this guide, we’ll cover the basics of wealth screening and how it fits into comprehensive donor research.

Looking for more insights on fruitful prospect research?

What Is Wealth Screening for Nonprofits?

Wealth screening (also known as a wealth assessment) is the process of identifying potential major donors based on public and third-party data that signals their financial capacity. This process relies on specific markers, such as estimated net worth, to determine whether a potential donor is financially capable of contributing a major gift.

Major gift officers (MGOs) often spearhead this effort, using prospect research tools to identify individuals with a certain level of wealth. After conducting donor wealth screening, MGOs can pair wealth markers with other signals of a likely prospect (e.g., high propensity to give, affinity for your cause) and hone their fundraising efforts.

How Does Wealth Screening Differ From Prospect Research?

Think of wealth screening as one piece of the prospect research puzzle:

- Prospect research is the process of understanding potential major donors’ abilities to give so you can cultivate strong relationships with the right individuals.

- Wealth screening is one task that occurs within the prospect research process, and it involves a nonprofit analyzing a potential donor’s financial capacity.

In other words, wealth screening gives you a glimpse into a donor’s financial landscape, but that’s only one part of their story. The potential to give is not equivalent to a donor’s likelihood of giving, but it’s necessary for estimating likelihood.

If you focus only on a prospect’s wealth, you fail to recognize the motivation (or lack of motivation) they feel toward supporting your cause. Is the prospect passionate about your work? Are their goals or priorities aligned with your nonprofit’s? Do any factors in their personal lives make this an inappropriate time to ask?

Understanding wealth screening in the context of prospect research is critical to using it wisely.

What Are Wealth Markers?

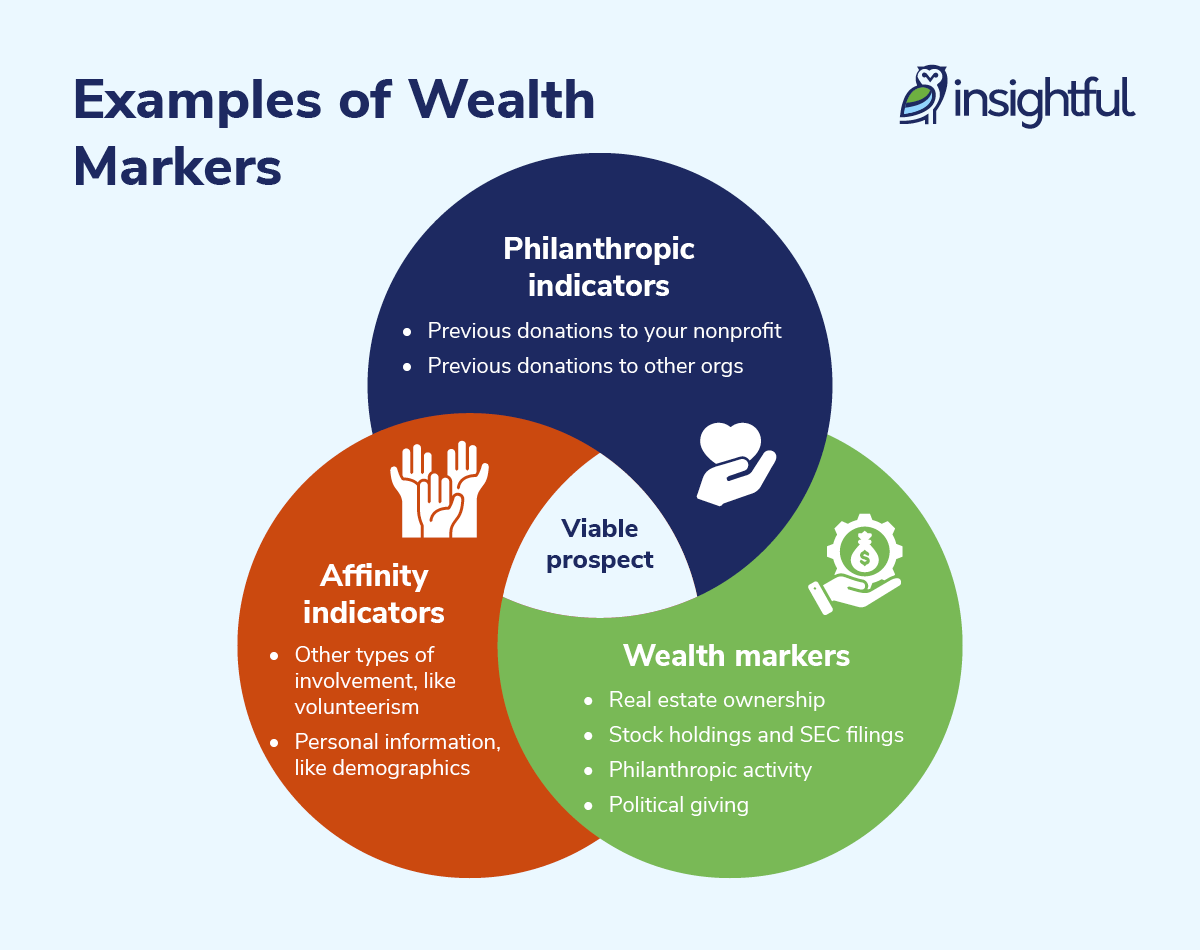

Wealth markers are the indicators used to estimate a potential donor’s financial capacity. They generally include assets and affiliations that suggest their ability to make a significant gift.

Examples of wealth markers include:

- Real estate ownership. Individuals with at least $2 million invested in real estate are 17 times more likely to donate than the average person.

- Stock holdings and SEC filings. Publicly traded shares or insider status in companies can signal not only financial strength, but also pathways to networking opportunities with business affiliates.

- Philanthropic activity. Past donations to other charitable causes suggest both capacity and interest in giving, which can also provide insight into a prospect’s values.

- Political giving. Contributions to political campaigns can also signal wealth and civic engagement.

While these indicators are common signals of a donor’s wealth, prospect researchers should be careful not to treat them as an exclusive checklist. You can easily overlook many wealth markers, so comprehensive prospect research is critical for identifying “hidden wealth,” or wealth represented in your nonprofit’s spheres of influence that you didn’t know about.

Benefits of Wealth Screening

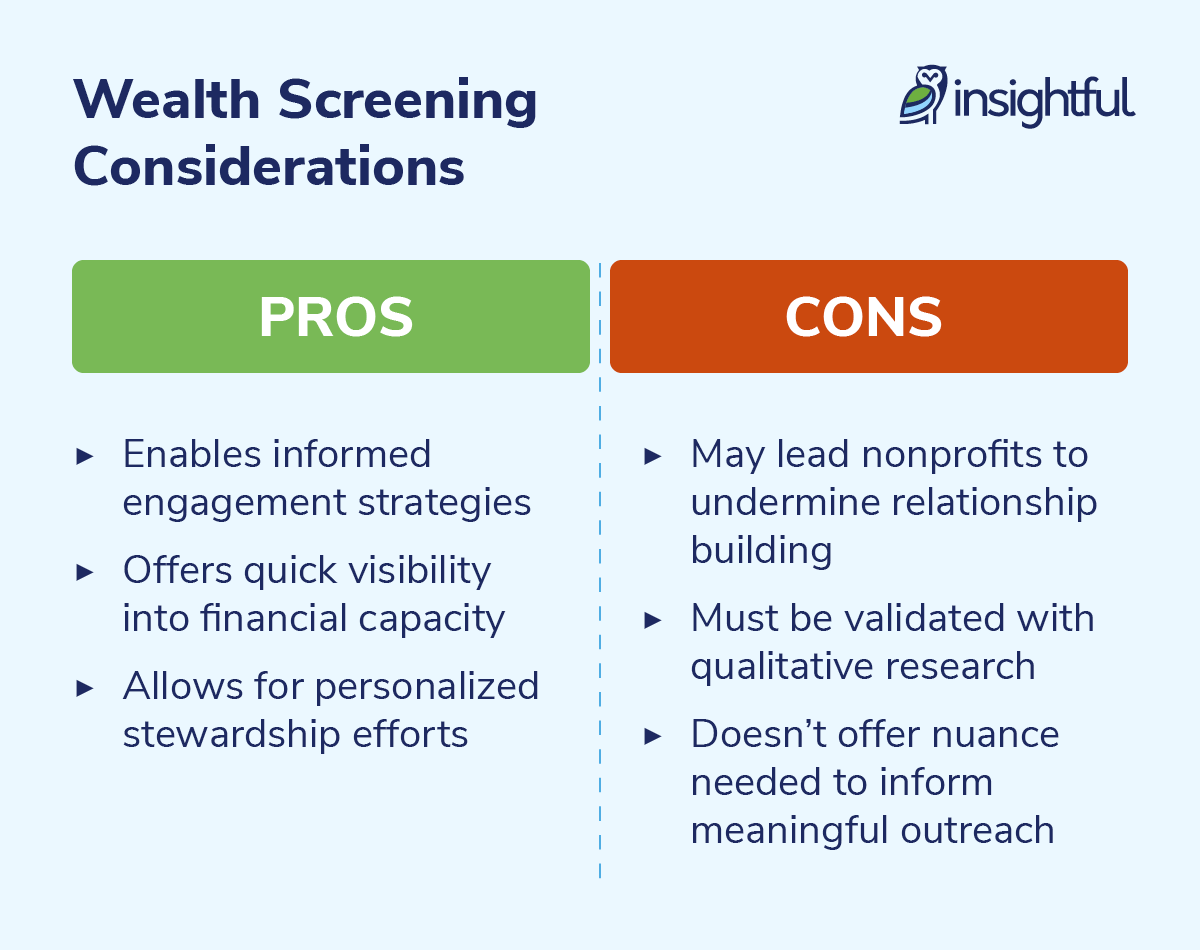

It’s no mystery that wealth screening helps nonprofits raise more funds. With targeted fundraising requests, your nonprofit can raise more from each ask, while also increasing donor retention through better-aligned messaging.

However, too many nonprofits jump into wealth screening without considering the bigger picture. Here are the benefits of wealth screening alongside relevant drawbacks to keep in mind:

Pro: Wealth screening data gives nonprofits a closer look into donors’ lives, providing context that can guide informed engagement strategies.

- Con: An overreliance on data can lead nonprofits to undermine relationship-building. Regardless of a prospect’s financial capacity to give, your nonprofit’s top priority should be cultivating meaningful donor relationships.

- Pro: Especially when leveraging automated wealth screening tools, you can gain quick visibility into prospects’ financial capacity.

- Con: Researchers must validate their findings with qualitative research to avoid the risk of false positives or misleading assumptions.

- Pro: By identifying wealth markers, nonprofits can personalize their stewardship efforts and make more reasonable fundraising asks.

Con: Wealth screening doesn’t offer the nuance needed to inform meaningful outreach. Other data must supplement wealth screening findings to account for critical context like donor interest or life stage.

Although there are important considerations to keep in mind when conducting donor wealth screening, don’t let these cautions deter you! Wealth screening is still a valuable resource for nonprofits and plays a huge role in prospect research—the key is knowing how to go about it.

Wealth Screening Best Practices

-

Choose A Donor Research Solution Over Wealth Screening Tools.

The first step in the wealth screening process is choosing software to actually screen prospective major donors. Naturally, your team may be inclined to search for “wealth screening tools” online or shop for a platform specifically tailored toward compiling wealth data. A word of caution: Don’t go with generic wealth screening tools.

Your nonprofit will get the most value from tools that provide comprehensive donor insights, not just net worth estimates. Here are some considerations to keep in mind when shopping:

- Artificial intelligence (AI) is not for everyone. AI-powered tools may sound like the way of the future for nonprofits, but they often provide no greater value than the results achieved by tools with automation. For organizations focused on building real, human-centered donor relationships, tools that emphasize timely, factual updates are far more valuable than AI-driven predictions.

- Consider tool usability before committing. Even wealth screening tools with the most impressive data capabilities are useless without an intuitive interface. After all, what good is wealth data if your nonprofit can’t access, interpret, or act on it? Select user-friendly tools with an accessible support team and resources to ensure you can make the most of the platform’s features.

- Software should cast a wide net and surface what’s most important. Choose tools that highlight context, not provide disconnected data points. Many research tools present themselves as invaluable resources for donor research, but they can't narrow down the exact insights that support your fundraising needs. For example, nonprofits that use Google Alerts for leads will quickly find that the platform delivers simple search results for exact keywords rather than comprehensive research on individuals and their related networks.

Donor news alert services, like Insightful Philanthropy, monitor information sources to notify nonprofits in real time when meaningful life events occur that could impact a donor’s involvement with the organization. This allows for more thoughtful communications rather than simply basing outreach on a prospect’s net worth.

For example, let’s say your nonprofit uses a donor news alert service and receives an alert when a long-time donor, John, acquires a new business. Your fundraising team might immediately flag John as a potential major donor. However, your donor news alert service also monitors obituary data and notifies you just a few days later that John’s spouse passed away. With this additional context, you know it would be better to send heartfelt condolences rather than a request for donations.

The more your nonprofit knows about its donors, the more you can raise.

See what it looks like to access wealth markers and other critical donor intelligence with a tool that empowers comprehensive donor research.

-

Prioritize Donor Data Privacy.

Wealth is a reasonably private matter for most people, and the wealth screening process taps into sensitive donor information. Your nonprofit’s commitment to protecting donor data not only safeguards their financial information but also demonstrates your organization’s trustworthiness.

Here are a few ways you can ensure donor data privacy:

- Adhere to data hygiene best practices. Regularly update your donor database to remove outdated or inaccurate information, and standardize data input processes to ensure consistency in your records.

- Implement internal policies. Create clear guidelines on who has access to donor data, how it's used, and when it must be deleted or anonymized.

- Disclose your wealth screening methods. Let donors know about your organization’s wealth screening practices, including the tools you use and the data you review.

As you implement the above practices, train your staff to ensure everyone is on the same page about how donor information should be handled. Conduct regular training sessions to review legal and ethical responsibilities and outline guidance in documents that team members can reference as needed.

-

Set a Refresh Cadence and Review Process.

While everyone’s financial situations fluctuate, high net worth individuals often experience more fluctuations due to market volatility, global economic conditions, and other factors. For example, entrepreneurs whose financial well-being is closely tied to the performance of their business may see their financial capacity change with market trends.

As such, it’s important to recognize wealth screening as an ongoing process rather than a one-and-done practice. Re-screening your database regularly ensures your team is equipped with the most up-to-date insights when making outreach decisions.

In other words, nonprofits should treat their donor data as a living asset that requires regular care. This may sound like a big commitment, but with tools that automate the donor research process and integrate with your constituent relationship management (CRM) system, you can rest assured that you’ll always have the most updated information available.

Expert Insight: Wealth Screening Matters, But Prospect Research Requires More Effort

Think of wealth screening as a starting point, not a strategy. When used thoughtfully, this process offers a powerful lens into donor capacity, which is a crucial edge for nonprofits looking to increase major giving revenue.

The best way to start your wealth screening journey is by recognizing its place in the overall prospect research process and preparing your team for all the tasks it entails. In the end, you’ll gain a more holistic view of your supporters, which drives deep relationships that yield greater gifts.

After all, the more you know, the more you raise!

Ready to look beyond wealth markers?

Tap into 14,000 news and information sources from 200+ countries for a complete view of prospects with Insightful Philanthropy.